Recent Posts

bhach

PSA: You are using new instance of Bharatchan

Jat vros

what the fuck

KINO ESOTERIC-SCHIZO CHANNELS & CONTENT

utho bhachads, time to ascend.

Bhaktimaxxing...?

How does picrel make physically weak manlet sister...

Chad Vision by me

Bhadwe sirs

Ravan hi bhagwan hai

What is worse and most cucked as a man?

Jai Bheem

Could anyone crosscheck?

Bhangali anon jara idhar aana

Helpu krdo techjeets ji

Feels aane lagi bros

chaddism

must...not...coom.....

IZREAL APPRECIATION POST

Xes2tN

No.463467

I hope this video will actually help me get some idea.

Xes2tN

No.463476

Well...

Xes2tN

No.463478

Xes2tN

No.463500

Land owner wins again:

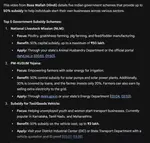

This video by Sanyam Indurkhya, a certified solar energy expert, provides an in-depth explanation of Component-A of the PM-KUSUM Yojana, focusing on starting a solar power plant business on uncultivated land.

What is PM-KUSUM Component-A?

Purpose: It allows individuals (not just farmers, but any land owner) to install solar power plants on uncultivated or barren land and sell the generated electricity to the government [01:25, 01:44].

Capacity: You can install plants ranging from 500 KW to 2 MW. Commonly, people install 1 MW (with 20% over-loading up to 1.2 MW) or 2 MW (up to 2.4 MW) systems [02:37, 03:00].

System Type: Only ground-mounted systems are allowed; rooftop solar is not part of Component-A [08:52].

Key Requirements and Eligibility:

Land: Approximately 3 to 3.5 acres are needed for a 1 MW plant, and 6.5 to 7 acres for a 2 MW plant [03:20].

Substation Proximity: The land must be within 5 km of a government substation. If the distance is greater, permission will likely be denied [03:36, 03:50].

Net Worth: A Net Worth Certificate from a CA is mandatory, requiring a net worth of ₹1 crore per MW [07:50].

Ownership: The land must be in the name of the applicant. Property in the name of ancestors is not eligible for loans or PPA [06:56].

Financial Details:

Power Purchase Agreement (PPA): The government signs a fixed PPA for 25 years at a rate of approximately ₹3.25 per unit [04:16, 05:04].

Loans: The government facilitates loans for 80–85% of the project cost at an interest rate of 9% to 10.5% for a 15-year period, subject to credit rating and bank approval [07:12, 07:33].

Subsidies: Unlike other components, there is no government subsidy for Component-A. However, this allows the use of Non-DCR panels (imported cells), which can be ₹10–12 cheaper per watt than domestic cells [08:59, 09:40].

Application Fees: A fee of ₹5,900 per MW is required during the application process [08:20].

Application Process:

Applications are not open year-round; they are released via tenders on the websites of state nodal agencies (e.g., Urja Vikas Nigam).

The process follows a "First Come, First Served" basis. Once the designated capacity of a substation is reached, no further applications are approved [05:32, 05:52].

Xes2tN

No.463519

This video from DIGITAL PATHSHALA provides a comprehensive guide on the Prime Minister's Employment Generation Programme (PMEGP) loan scheme for starting new businesses in India.

PMEGP Scheme Overview:

Objective: To generate employment by providing loans for new manufacturing or service-oriented ventures [01:28].

Maximum Loan Amount:

Manufacturing Sector: Up to ₹50 lakh.

Service Sector: Up to ₹20 lakh [01:52].

Subsidy Percentage (Based on Category & Location):

General Category: 15% (Urban) or 25% (Rural). Self-contribution: 10%.

Special Category (SC, ST, OBC, Minorities, Women, Ex-Army): 25% (Urban) or 35% (Rural). Self-contribution: 5% [03:02, 04:03].

Subsidy Lock-in: The subsidy amount is frozen in a separate account for 3 years, after which it is adjusted against the loan [04:56].

Eligibility and Requirements:

Applicant: Must be an Indian citizen, at least 18 years old, and not a previous beneficiary of any government subsidy scheme [06:00, 06:16].

Educational Qualification: For projects above ₹10 lakh (Manufacturing) or ₹5 lakh (Service), the applicant must have passed at least 8th standard [07:04].

Creditworthiness: A good CIBIL score is required; defaulters are ineligible [06:07].

Priority: Applicants who have received training from government institutes or hold an EDP (Entrepreneurship Development Programme) certificate are given preference [06:21, 06:41].

Mandatory Documents:

Aadhar Card (linked to mobile number) and ID proof (Voter ID, DL, etc.) [06:51].

Residence proof and 8th-standard pass certificate [07:01, 07:04].

Business Project Report (prepared by an authorized CA) [07:09].

Land documents (registry or lease agreement) and bank statement for the last 6 months [07:25, 07:35].

Category/(indian) certificate (if applying under the Special Category) [07:20].

How to Apply (Online Only):

Visit www.janusamarth.in to check eligibility and get an estimate of your potential loan and subsidy [08:16].

The site will redirect you to the official PMEGP portal: www.kviconline.gov.in [08:39].

Fill in the detailed application form, attach required documents, and submit [08:51].

Important Note: The PMEGP scheme is only for new businesses; existing businesses should look into other schemes like Pradhan Mantri Mudra Yojana [05:05].

Watch the full step-by-step guide here: PMEGP Loan and Subsidy 2025/2026

>Special Category (SC, ST, OBC, Minorities, Women, Ex-Army): 25% (Urban) or 35% (Rural). Self-contribution: 5% [03:02, 04:03].

No wonder so many muslims have some manufacturing plant